The CDTI Innovation invests, together with ASABYS and Criteria Bio Ventures, MEDLUMICS, S.L., company dedicated to the development of medical devices based on high technology

The CDTI Innovation, through its programme, together with Innvierte ASABYS, through their vehicles SABADELL ASABYS HEALTH INNOVATION INVESTMENTS SCR, S.A. and ASABYS TOP UP FUND. F.C.R., S.A., and CRITERIA BIO VENTURES SICC, S.A., has reached an agreement with the partners of MEDLUMICS, S.L. for a new investment in the company

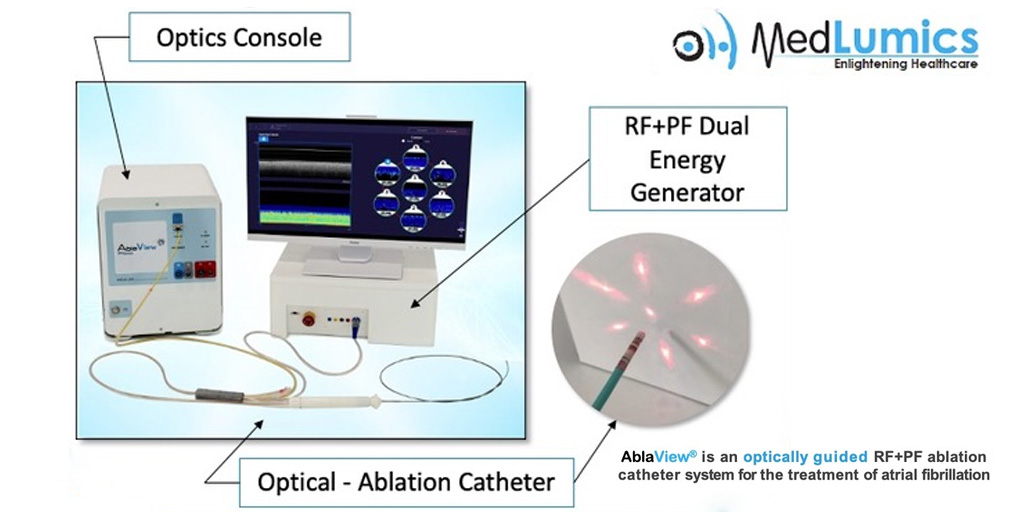

MedLumicsit is a company of medical devices which develops AblaView ®, the first ablation catheter in real time guided Optically for the treatment of atrial fibrillation (FA).

The atrial fibrillation is the most common type of cardiac irregular heart rate and it is estimated that currently affects 43 million people around the world. The recurrence of fmd remains very high, and more than 20 per cent of patients are subject to a new circumcision in the first year since the initial treatment. Innovations in this area in the past 20 years have been ineffective in reducing the rate of complications resulting from the thermal energy or mitigation of recurrencias and repetition rates derived from the treatment procedures incomplete.

AblaView, a system of hybrid catheter guided Optically, is a pioneering system in the world that incorporates the Reflectometría coherence Lens (OCR) to provide the electrofisiólogo (EF) a visual guide that allows you to assess first-hand and in real time the progression of the injury.

Current technologies requires the electrofisiólogo based on indirect markers that provide indirect information outside of heart tissue that it was trying to guide the proceedings. The second hand information leads to an incomplete treatment, which triggers the recurrence of the FA, increasing the costs by the repetition of treatment and, more seriously, the over-treatment, causing life-threatening complications, such as the disorder and fistula -perforación of plugging problems.

The dual energy AblaView is a real game changer "". The OCR technology directly measuring the Optical properties of the organization of the tissues, called birrefringencia, as it applies the ablation therapy with energy radiofrequency (RF) or electroporation irreversible (IRE). The measurement of Optical birrefringencia provides information to guide and direct confirms the stability of the contact of the tip of the catheter with fabric, the depth of the progression of the injury and durability of the injury with precision and unprecedented specificity. The guide In real time allows for the first time the electrofisiólogo monitoring the implementation of energy to avoid complications thermally accurately predict the full treatment of patients to improve security and reduce the recurrence of the FA. Commercially, double energy extends the penetration of aurícula AblaView from to the market billionaire and untapped the ventricular tachycardia episode.

Asabys Partners

Asabys Partners is a specialized risk capital in health, founded in 2018 by Josep Ll. Sanfeliu and clear, shared by Campàs Alantra and with the support of the Banco Sabadell anchor. investor Almost €225 million in assets under management and 16 investees (+ 1 exit), Asabys invests in innovative companies disruptive and addressing unmet medical needs in the areas of biotechnology and pharmaceuticals and health technology investment in this company has been made since their vehiclesSabadell Asabys Health Innovation Investments SCR, SAandAsabys Top Up Fund, RCF.

Criteria Bio Ventures

Criteria Bio Ventures, is a specialized fund invests in biotechnology companies and health sciences. Invests in companies that proposed disruptive treatment approaches focusing on addressing unmet medical needs, with focus mainly on Spain, Portugal and the rest of Europe. Criteria Bio Ventures is part of the Caixa Capital manager Risc, with more than 200 million euros under management. It is part of the group CriteriaCaixa, the largest investment holding in spain with more than 25,000 billion in assets. The fund has been investing since 2007 and the companies in its portfolio have come to a bag or have been acquired by reputable companies as AstraZeneca, Boheringer Ingelheim, Vifor Pharma, Qiagen, Apple, Meta, Airbnb, Vente-Privee, Pernod Ricard, Repsol and other similar.

CDTI Innovation

The CDTI innovation is the public funding of innovation of the ministry of science, innovation and universities that promotes innovation and technological development of spanish companies, channeling requests for funding and support for r & D & I projects of spanish entities at the state and international levels. We Contribute to the improvement of the technological level of spanish companies and drive and, with an international network with coverage of 51 countries support the spanish participation in international programmes for technology cooperation and the international transfer of technology.

Additionally, through the initiative Innvierte Sustainable Economy, supports and facilitates the capitalization of technology companies. Since 2012 and to date, the CDTI Innovation, through Innvierte, has committed over 792 M €in 28 investment vehicles that have invested in more than 250 businesses, and through its joint investment line directly committed an amount of more than 470 M €in 151 companies.

More information:

Office of the press

prensa@cdti.es

91-581.55.00

On The Internet

Website:www.cdti.es

In Linkedin:https :// www.linkedin.com/company/29815

X:https :// twitter.com/CDTI _ innovation

On Youtube:https :// www.youtube.com/user/CDTIoficial

This content is copyright © 2024 CDTI, Soes. Permitted for use and reproduction by quoting the source and digital identity of CDTI (@CDTI _ innovation).